The Rules have changed & Construction businesses are no longer penalized for accepting credit card.

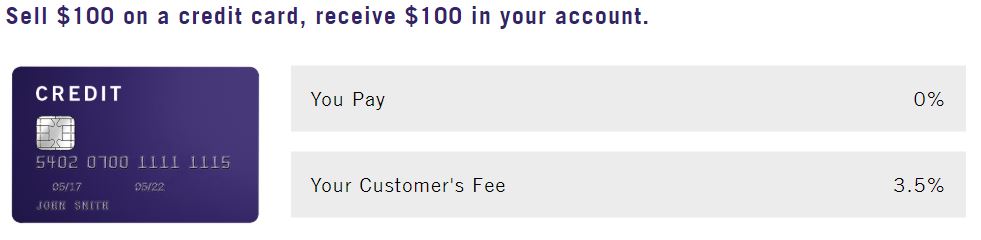

PAY 0% TO ACCEPT CREDIT CARDS

Pay 0% on all credit card transactions Our surcharging solution keeps you 100% Compliant, ready to accept credit cards without any equipment requirements The surcharge passed onto your customers who choose to use a credit card. The customer is only surcharged on credit card, no surcharge fee on debit.

Unless businesses pass on the credit card fee, they have to either raise prices across the board

- harming customers who pay with cash or debit

- or accept a lower profit margin on credit card sales.

Program complies with all rules to make sure you are covered. It is virtually impossible to surcharge your clients without a solution like ours. We can serve businesses in 44 states except. We do not yet serve companies in CO, CT, MA, ME, OK and KS.

Program Can be set up for all payment environments, whether you need to take payments online, over the phone or in person.

Do you know businesses that could benefit from this program? Our merchant service referral program allows you to earn residual income from accounts set up.

No upfront cost, or long term contract to apply

Why can't I just add a fee myself?

You must follow the rules of the card brands in order to add a fee for credit card. Non Compliance can result in termination or fines.

SURCHARGING COMPLIANCE RULES

Merchant must be registered with the card brands

- Our solution handles the registration process on your behalf.

The Merchant must tell their customer about the credit card fee

- When customers pay online or via virtual terminal it needs to state the fee at the point of sale.

- If they are taking card present transactions they need to have appropriate signage at store entrance.

- If customers are paying over phone they need to be told.

Our solution has you covered

The credit card fee cannot exceed 4%

- Our solution adds 3.5% so you are covered

Merchant cannot profit from transaction

- At point of sale most businesses do not know the exact cost of the credit card they are processing. This makes it virtually impossible for them to add a fee because if the fee is more than the cost they are profiting from the transaction. Our solution makes it so that the merchant cannot profit of the transaction.

The price of the product or service and the credit card fee must be processed as one transaction

- Our solution processes them both as one transaction, ensuring you are covered.

The receipt must show the total amount of the credit card fee as a separate line item

- Our solution shows the total amount of the credit card fee as a separate line item.

The merchant cannot surcharge on debit cards

- This means that their software must be able to differentiate between debit and credit. If a customer runs the debit card as credit and is surcharged this would not be compliant.

Businesses in the following States cannot surcharge

- Colorado, Connecticut, Massachusetts, Maine, Oklahoma and Kansas

No longer do you need to avoid taking credit card

Solution costs the construction business less process credit card than check, ach or wire. Charge $1,000 and Receive $1,000. Now you can let all customers know that you take credit card without hurting your bottom line.

No more limiting the amount you take on credit card

Our solution allows businesses to accept credit cards and pay 0% in processing fees. No longer do you have to limit the amount you will take on credit card because it will be zero cost.

Increase Invoice Turnover Rates

Increase invoice turnover rates by inserting a pay by credit card link to invoices. Now customers can pay by credit card and you receive the total invoice amount.