Business Short Term Working Capital Loans

These days business owners have a wide range of funding options available to them. Short term working capital, line of credit, business term loan, merchant cash advance, invoice financing, purchase order financing, equipment financing, equipment leasing, equipment refinancing, and the list goes on.

- What is business short term working capital?

- What are the pros and cons of a short term working capital loan?

- How to apply for short term working capital

- How to get the best working capital loan options

- Best time for your business to apply for a short term working capital loan

- Alternative options to business short term working capital

What Is a Business Short Term working capital Loan?

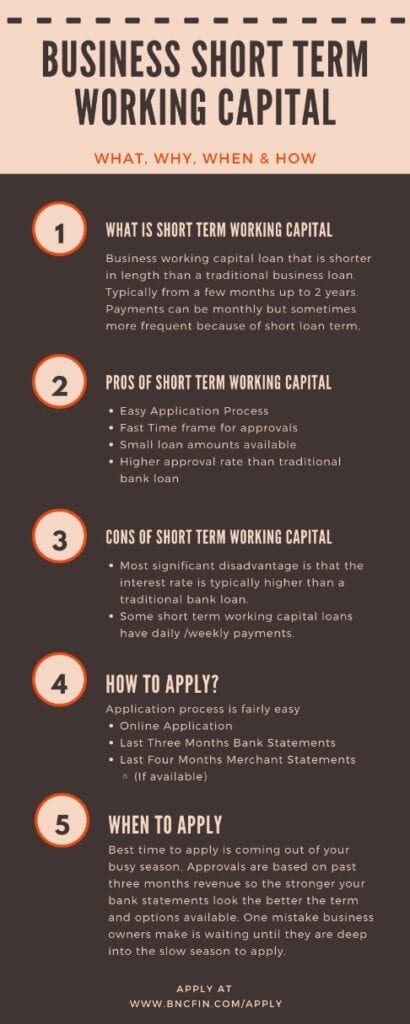

As the name indicates, a short term working capital loan is a business loan that is typically shorter in length than a traditional business loan. Not only is the term shorter, but so is the application and approval process for short term business loans. Term lengths of short term business loans typically range from as little as a few months up to 24 months.

What are the pros and cons of short term working capital Loans

Easy Application Process

As indicated above, short term working capital loans are much easier to apply for than a traditional business loan. Most traditional bank loans require in-depth paperwork and documentation, taking weeks or months to get an approval or decline. Because of this, conventional business loans are typically not a viable option when a business is experiencing urgent, unexpected business expenses.

Higher Approval Rates than Traditional Loans

Another advantage of short term business loans is that the underwriting requirements are typically much more relaxed. It easier for businesses to get approved for short term working capital loans as opposed to traditional business loans.

Borrow Smaller Amounts

Another benefit of short term working capital loans is that businesses can borrow smaller amounts of money. Many traditional business loans have minimum loan request requirements meaning that they may have to borrow more money than they need. Or the end up being declined for applying for a loan under the minimum requirement.

Ideal for Short Term Opportunities

Short Term, Working Capital loans can be a great option to get over short term and temporary financial hurdles. Some businesses don't like the idea of being stuck paying off a loan for several years after the first use of funds has passed.

Some Short Term Working Capital Loans can Increase Business Credit

For newer businesses, short term working capital can help improve your business credit score. As a company develops its credit score, it will have an easier time getting approved for more substantial loans in the future. When applying for a short term working capital loan inquire if it will help build business credit. Some funding sources report to the business credit agencies and some do not.

Higher Interest Rates than Traditional Business Loans

The most significant disadvantage to short term working capital loans is that the interest rate is typically higher than the interest rates on a traditional business loan. Also, because of the shorter terms, these loans sometimes have more frequent payments that are daily and weekly. Not all short term working capital loans are daily and weekly payments though, sometimes they have monthly payment options.

Advantages of Business Short Term Working Capital

Disadvantages of Business Short Term Working Capital

Looking for something else?

How to Apply for Short Term working capital loans

The application process is much easier for short term working capital loans. Sometimes its as simple as an online application, three months bank statements, and four months merchant statements (if your business accepts credit cards).

How can your business get the best short term working capital loan?

Lenders underwrite Short term working capital loans based on past revenue. Most lenders will analyze the business's last three months of bank statements. The stronger their previous months' bank statements are, the better the terms and structures you will qualify for. One mistake many businesses make is waiting too long to apply for the capital they need. They have an event that strains their money but waits until they run out to apply. Then when they apply, the bank statements have low balances or revenue, and they receive terms based on this.

When is the best time for your business apply for a short term working capital loan?

The quick and easy approval process makes short term working capital loans an excellent option for businesses with unexpected or emergencies. Sometimes companies don't have time to apply for a traditional business loan when they need immediate funds.

Business Line of Credit

A business line of credit represents a versatile solution to meet your evolving cash flow requirements. Unlike a term loan,…

Read MoreMerchant Advance

Key Features Funding from $5,000 to $2 Million Approvals are based on overall business performance not just credit card score.…

Read MoreEquipment Refinance

Program Description Flexible program that allows you to refinance an asset. It can be used three different ways. Refinance an…

Read MoreInvoice Factoring

Invoice Factoring B2B organizations typically offer credit terms to their customers. These can sometimes range between 30 and 90 days.…

Read MoreSoftware Financing

BNC Finance offers software financing solutions for businesses to acquire the necessary software for their operations, such as accounting software,…

Read MoreShort Term Working Capital

Business Short Term Working Capital Loans These days business owners have a wide range of funding options available to them.…

Read MoreAsset Secured Financing Programs

Overview Asset Secured Structured Financing allowing businesses the ability to unlock significant capital and overcome business challenges while breaking through…

Read More