Understanding Section 179 for Drone Service Providers

As a drone service provider, staying ahead in a competitive market often requires significant investments in cutting-edge equipment and software. Fortunately, IRS Section 179 Tax Deduction offers an excellent opportunity to reduce your tax burden by allowing you to write off the cost of qualifying business assets in the year they are purchased.

This guide explains how Section 179 works for drone service providers, helping you understand its potential benefits. However, you should always consult a qualified tax professional to determine how this deduction applies to your specific circumstances.

Table of contents

What is Section 179?

IRS Tax Code Section 179 allows companies to deduct the full purchase cost of qualifying equipment and software in the year it is placed into service. Unlike traditional depreciation, which spreads deductions over several years, Section 179 provides immediate tax benefits.

For drone service providers, this deduction can apply to:

- Drones and hardware used for aerial mapping, photography, inspections, and other services.

- Specialized sensors such as multispectral or hyperspectral imaging devices.

- Software for flight planning, data analysis, or photogrammetry.

- Accessories like batteries, controllers, or payload systems.

How Section 179 Applies to Drone Equipment

To qualify for Section 179, equipment must meet the following criteria:

- Business Use: Equipment must be used for business purposes at least 50% of the time.

- Tangible Assets: Items must be physical, such as drones, cameras, or controllers.

- In-Service Date: The equipment must be put into service during the same tax year you are claiming the deduction.

These rules make Section 179 especially beneficial for drone service providers, who often rely on expensive, high-tech equipment to deliver their services.

2024 Section 179 Limits

For the 2024 tax year, Section 179 allows businesses to deduct up to $1.16 million in qualifying equipment purchases. The deduction starts to phase out when total equipment purchases exceed $2.89 million. These limits are adjusted annually for inflation.

Why Section 179 is Valuable for Drone Businesses

- Immediate Tax Savings: Instead of waiting to recover costs over several years through depreciation, Section 179 allows you to deduct the full amount in the year of purchase.

- Encourages Business Investment: By reducing upfront tax burdens, Section 179 enables you to invest in better equipment, expand your services, or allocate funds to other growth areas.

- Applies to Financed Equipment: Even if you finance your equipment through providers like BNC Finance, you can still claim the full deduction, making this an attractive option for managing cash flow.

How to Claim Section 179

- Buy or Finance Qualifying Equipment: Ensure your purchases meet the eligibility requirements.

- Place the Equipment Into Service: Confirm the asset is operational within the tax year.

- File IRS Form 4562: Use this form to claim your Section 179 deduction.

- Keep Records: Maintain detailed documentation, including purchase invoices and service dates.

Example: Drone Business Using Section 179

Suppose your drone service business invests in the following:

- Commercial Drone: $18,000

- Thermal Imaging Camera: $12,000

- Flight Planning Software: $4,000

Total Equipment Cost: $34,000

By using Section 179, you can deduct the full $34,000 from your taxable income, potentially saving thousands in taxes depending on your tax bracket.

Common Questions About Section 179

- Does Used Equipment Qualify?: Yes, as long as the equipment is new to your business and meets all other eligibility requirements.

- What if I Use the Equipment Personally?: Equipment must be used for business purposes at least 50% of the time to qualify.

- Can I Deduct Leased Equipment?: Certain leases qualify under Section 179; check with your finance provider or tax professional for details.

Important Disclaimer

While this article provides a general overview of Section 179, it is not a substitute for professional tax advice. You should consult a qualified tax professional to understand how Section 179 applies to your specific situation, including eligibility, limitations, and compliance requirements.

Take Advantage of Section 179

Investing in your drone service business is essential for growth, and Section 179 makes it easier to afford state-of-the-art equipment. If financing your equipment is the best option for you, BNC Finance offers competitive rates and terms, so you can leverage Section 179 without straining your cash flow. Contact us today to learn more!

Section 179 is a powerful tax-saving tool that can help drone service providers reduce expenses and accelerate growth. Be sure to explore this deduction with your tax professional and take full advantage of the opportunities it provides.

Apply Now for Drone Financing & Leasing

Financing and Leasing Options for all the UAV Equipment your business needs

One Application to bundle together multiple vendors

- UAV Hardware

- UAV Software

- Include soft costs such as training, shipping and maintenance agreements

Our Blog

Drone Related Articles you might be interested in....

Maximizing Tax Savings: Section 179 for Drone Service Providers

Understanding Section 179 for Drone Service Providers As a drone service provider, staying ahead in a competitive market often requires…

16 Unique Agricultural Spray Drones Uses Revolutionizing Modern Farming

16 Unique Agricultural Spray Drone uses Revolutionizing Modern Farming In recent years, agricultural spray drones have rapidly transformed the landscape…

Innovations in Precision Agriculture: The Emergence of Drone Technology in Planting

The agricultural sector is poised for a technological revolution, with drone innovations marking a pivotal shift in farming methodologies. Specifically,…

The Role of Drones in Precision Agriculture: Elevating Farming Efficiency to New Heights

Precision agriculture marks a paradigm shift in how farming approaches, moving from traditional, broad-scale strategies to highly efficient, data-driven methodologies.…

11 Ways Drones are Revolutionizing Agriculture

The incorporation of drone technology into the agricultural sector represents a significant transformation in farming methodologies, encompassing crop cultivation, monitoring,…

Revolutionizing Maintenance: The Future of Power Washing Drones

Revolutionizing Maintenance: The Future of Power Washing Drones. with Robert Dahlstrom, CEO of Apellix Drones In an engaging interview, Robert…

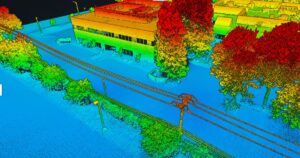

Harnessing the Power of Drone LiDAR for Land Surveying

Harnessing the Power of Drone LiDAR for Land Surveying: Insights with Harrison Knoll with Harrison Knoll, CEO of Rock Robotic…

Navigating FAA Changes: A Chat with Bryan Sanders on Agricultural Spray Drones Regulations

Part 137 Changes Impacting Agricultural Spray Drones with Bryan Sanders, President of (HSE) UAV, In an industry impacted by dynamic…

Real Estate Photography and Videography Drone Financing

Real Estate Photography & Videography Drone Financing & Leasing Real estate agencies need high-quality photos and videos to market their…

Engineering Drone Financing and Leasing

Engineering Drone Financing and Leasing Drone technology has been a game-changer for engineers. Through the use of drones, engineers can…

Roofing Drone Financing and Leasing

Roofing Drone Financing and Leasing Roof inspections can be time-consuming, challenging, and even dangerous. Fortunately, technology has offered a better…

Drone LiDAR Sensor Financing and Leasing

Drone LiDAR Sensor Financing and Leasing A Light Detection and Ranging (or LiDAR) sensor emits light energy to scan the…

Inspection Drone Financing and Leasing

Inspection Drone Financing and Leasing There are a number of industries that require regular visual inspections as part of their…

Startup Business Commercial Drone Financing & Leasing

Startup Business Commercial Drone Financing and Leasing Start a Drone Service Business Today with Financing and Leasing options for your…

Survey Drone Financing & Leasing

Survey Drone Financing & Leasing Drones have revolutionized the survey process, making it easy to fully assess and document large…

Agriculture Drone Financing

Agriculture Drone Financing BNC Finance offers a range of financing and leasing options for these and other agricultural drones used…

Construction Drone Financing

Construction Drone Financing Technological advances have revolutionized the construction industry. One of the most significant developments is the use of…

Commercial Drone & UAV Financing

Drone (UAV) Financing & Leasing Most businesses have trouble where to find commercial drone & UAV financing. Many financial institutions…