In order to manage receivables effectively, businesses need to avoid past due receivables and collections.

Use an alternate solution to extending terms to customers. Don’t extend terms to risky businesses. Implement a legally compliant surcharging solution.

This will allow you to get paid upfront and reduce risk while your customer covers the cost of extended terms. Increasing receivable turnover and reducing collections for a low FIXED monthly fee.

B2B businesses typically do not accept credit cards because of the fees associated with processing transactions. If you think about what a credit card does, is it extends terms to your customers but the business covers the processing costs. By implementing a credit card surcharging solution the business is able to extend terms to everyone at no cost or risk while getting paid upfront.

How to Improve collection processes and increase receivable turnover

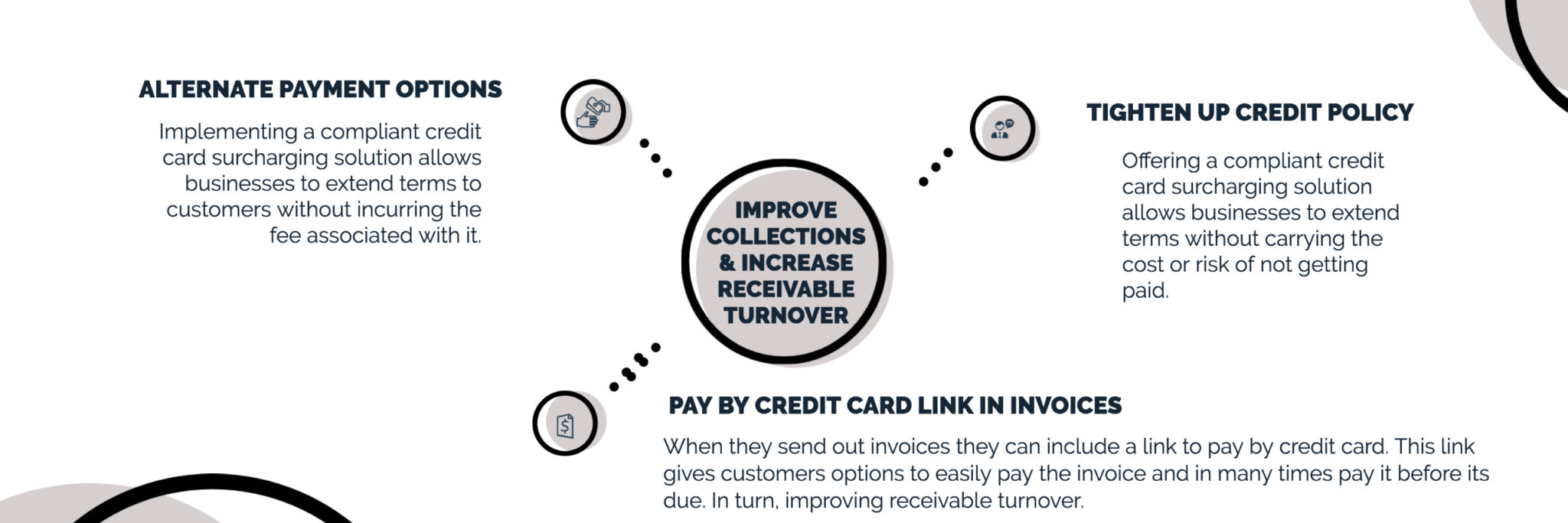

All businesses have had collection issues, and even more so in the B2B space. These collection issues can have a huge impact on a business's cash flow. Most B2B businesses are extending terms to customers. In other words, they are providing a product or service and giving the customers time to pay them. This time frame can be anywhere from a few days to several months. The diagram below shows what businesses should be implementing into their cash flow strategies.

Cash Flow Strategies to Improve Accounts Receivable Turnover

Offer alternative payment options

What does a business do when the customer does not pay them? Some businesses do nothing others call customers and reach out with alternate options such as paying by credit card. When a customer pays with a credit card they are given one month to pay the bill and the business pays the processing fees for a credit card. This means when a business accepts credit cards on past due to companies they are effectively giving them one more month to pay and incurring the cost associated with this. It is not an effective cash flow strategy to cover the cost of credit cards from customers when you are extending terms to them.

Implementing a compliant credit card surcharging solution allows businesses to extend terms to customers without incurring the fee associated with it. This means that when the customer is ready to pay the businesses do not carry additional costs. Also, keep in mind some people pay with credit cards not because they need to but because they want points or rewards. A surcharging solution disincentivizes the customer to pay with a credit card while giving them the option to do so. A win-win for the business.

Tighten up a credit policy

Customers who do not pay are a function of who you are extending terms to. Make sure you have parameters for businesses you are extending terms to. Many businesses make the mistake of extending terms for large transactions because they want to earn the business, the problem is that these large transactions can be detrimental to a company if they do not get paid on time.

Offering a compliant credit card surcharging solution allows businesses to extend terms without carrying the cost or risk of not getting paid. The business gets paid the total amount upfront and the customer has 30 days to pay the credit card bill.

Pay by credit card link in invoices

Most B2B businesses avoid accepting credit cards because the transaction fees have a huge impact on their bottom line. When you have large transaction amounts and low-profit margins paying credit card fees can eliminate all your profits. When businesses set up a compliant surcharging solution they are actually paying zero cost to process credit cards because the customer is covering the fees for the credit card. This means that businesses pay less to process a credit card than they would process an ACH or wire transaction.

By implementing a compliant credit card surcharging solution the business can advertise accepting credit cards on large transactions without hurting their bottom line. When they send out invoices they can include a link to pay by credit card. This link gives customers options to easily pay the invoice and in many times pay it before its due. In turn, improving receivable turnover.

Can I just accept credit cards and charge customers more?

In order to pass on the fee to customers, you need to make sure you are following all compliance requirements set by the card brands. You cannot simply just add a fee. If you do not follow all the rules set by the card brands you run the risk of being terminated by them for accepting credit cards and/or fined.

Accept Credit Cards for 0%

Instantly Improve profit margins and stop paying expensive fees to accept credit card. Our surcharging solution passes on the fee to the consumer and you pay 0% in processing fees to accept credit cards. Some State Restrictions*

Can businesses charge a fee for paying with a credit card?

Are businesses allowed to charge a fee when a customer pays with a credit card? With the increasing costs of…

How Does a Merchant Cash Advance Loan Work? (MCA)

What is a Merchant Cash Advance Loan? Tired of going through the hurdles of securing a bank loan for your…

3 ways for Businesses to cut costs

Ways for Businesses to Cut Costs As a business owner, you should always be keeping your eye on your bottom…

Can Businesses Legally Pass on the Credit Card Processing Fee to the Customer

Most Businesses are not following the rules set by the card brands regarding surcharging. In order to to pass on…

Is a Cash Discount Program a Compliant alternative to surcharging

Why most cash discount programs are not compliant This video goes over why most cash discount programs are not compliant.…

7 Benefits of Businesses Leasing Equipment and Not Paying Cash

Why You Should NOT Pay Cash For Your Business Equipment For business, maintaining a positive cash flow is absolutely…

Keeping our Money is not “Square” with me, Square holding onto 30% of customer payments during the pandemic

Keeping our money is not “Square” with me. According to a recent NY Times article, up to 30 percent of…

5 Reasons you should replace equipment before it breaks

5 Reasons you should replace business equipment before it breaks Using equipment to the end of its life cycle has…

Expanded Industry Financing Solutions

Automotive Equipment Financing & Leasing Auto Lifts Tire Balancing Machine Smog Test Machine Auto Repair Equipment Windshield Repair Equipment Restaurant…

Benefits of Financing your Business Equipment

Advantages of Financing and Leasing Commercial Equipment Financing and leasing equipment offers substantial business benefits, especially for startups and established…